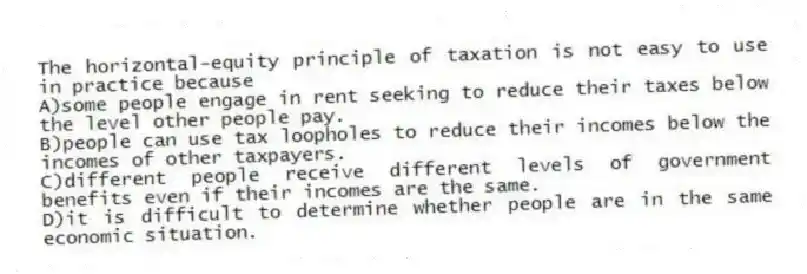

The horizontal-equity principle of taxation is not easy to use in practice because

A) some people engage in rent seeking to reduce their taxes below the level other people pay.

B) people can use tax loopholes to reduce their incomes below the incomes of other taxpayers.

C) different people receive different levels of government benefits even if their incomes are the same.

D) it is difficult to determine whether people are in the same economic situation.

Correct Answer:

Verified

Q123: The excess burden of a tax

A)measures the

Q124: The marginal tax rate is

A)the amount of

Q125: The average tax rate is calculated as

A)total

Q126: According to the ability-to-pay principle of taxation

A)individuals

Q127: According to the benefits-received principle of taxation

A)individuals

Q129: Horizontal equity means that two people in

Q130: In the United States, the federal income

Q131: If the marginal tax rate is greater

Q132: Table 18-8 Q133: Suppose the government wants to finance housing

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents