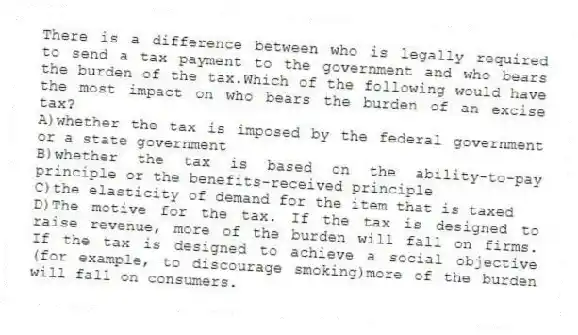

There is a difference between who is legally required to send a tax payment to the government and who bears the burden of the tax.Which of the following would have the most impact on who bears the burden of an excise tax?

A) whether the tax is imposed by the federal government or a state government

B) whether the tax is based on the ability-to-pay principle or the benefits-received principle

C) the elasticity of demand for the item that is taxed

D) The motive for the tax. If the tax is designed to raise revenue, more of the burden will fall on firms. If the tax is designed to achieve a social objective (for example, to discourage smoking) more of the burden will fall on consumers.

Correct Answer:

Verified

Q178: When the demand for a product is

Q179: Figure 18-1 Q180: Figure 18-1 Q181: If the government wants to minimize the Q182: Article Summary Q184: For a given supply curve, the deadweight Q185: Explain the effect of price elasticities of Q186: The person or firm that pays a Q187: A study by the Congressional Budget Office Q188: How would the elimination of a sales

![]()

![]()

State tax revenue from marijuana sales

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents