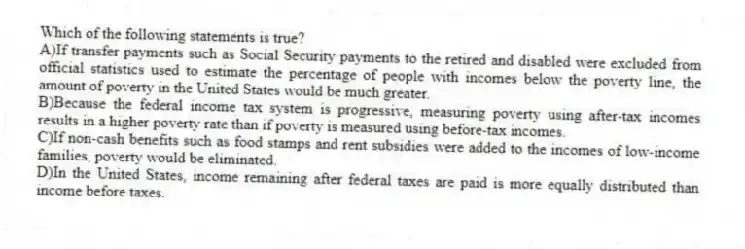

Which of the following statements is true?

A) If transfer payments such as Social Security payments to the retired and disabled were excluded from official statistics used to estimate the percentage of people with incomes below the poverty line, the amount of poverty in the United States would be much greater.

B) Because the federal income tax system is progressive, measuring poverty using after-tax incomes results in a higher poverty rate than if poverty is measured using before-tax incomes.

C) If non-cash benefits such as food stamps and rent subsidies were added to the incomes of low-income families, poverty would be eliminated.

D) In the United States, income remaining after federal taxes are paid is more equally distributed than income before taxes.

Correct Answer:

Verified

Q246: Figure 18-9 Q247: The federal government does not tax employees Q248: Economists caution that conventional statistics used to Q249: Between 1970 and 2010, the poverty rate Q250: From 1970 to 2010, the poverty rate Q252: What is the difference between the poverty Q253: If the Gini coefficient for Cartland is Q254: Compare the distribution of income in the Q255: Income inequality increases as the Gini coefficient Q256: Table 18-11

![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents