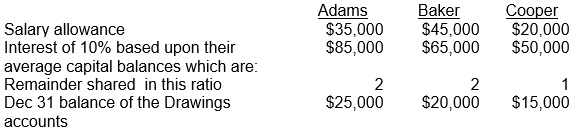

ABC Partnership has a profit of $150,000 for the year ended December 31, 2011. The partnership agreement states that profit and losses are to be distributed using salary allowances, interest allowances, and a ratio for the remainder. Information about the agreement and the balance of the Drawings accounts is contained in the table below.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(b) Assume that the revenue and expense accounts have been closed. Prepare the remaining closing entries.

Correct Answer:

Verified

Q8: Admission of a new partner to the

Q9: If a partnership is admitting a new

Q10: Upon liquidation, once the assets have been

Q11: Which one of the following is not

Q12: B invests $60,000 for a 25% interest

Q13: Partners A and B receive a salary

Q14: After selling the assets and paying the

Q15: Selling partnership assets and paying the proceeds

Q17: On July 1, the Duncan & Evan

Q18: Define Limited Partnerships and Limited Liability Partnerships,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents