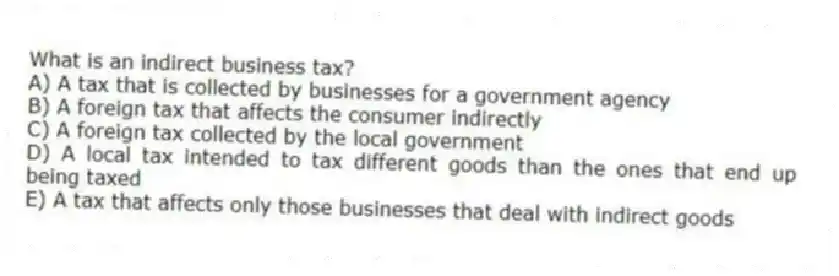

What is an indirect business tax?

A) A tax that is collected by businesses for a government agency

B) A foreign tax that affects the consumer indirectly

C) A foreign tax collected by the local government

D) A local tax intended to tax different goods than the ones that end up being taxed

E) A tax that affects only those businesses that deal with indirect goods

Correct Answer:

Verified

Q31: Real GDP measures

A) personal income adjusted for

Q32: The price index for the current year

Q33: Consider GDP calculated as expenditures. GDP would

Q34: For a hypothetical economy in a given

Q35: A reduction in the value of capital

Q37: World GDP is _ World GNP.

A) more

Q38: The difference between gross investment and net

Q39: GDP can be calculated by all of

Q40: National income is

A) personal income plus personal

Q41: If 1 U.S. dollar = 11.76 shillings,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents