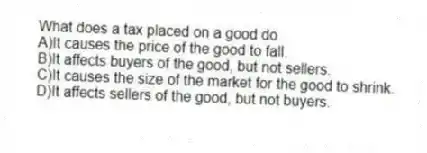

What does a tax placed on a good do

A) It causes the price of the good to fall.

B) It affects buyers of the good, but not sellers.

C) It causes the size of the market for the good to shrink.

D) It affects sellers of the good, but not buyers.

Correct Answer:

Verified

Q30: How is tax burden related to the

Q31: When a tax on a good is

Q32: When a tax is levied on a

Q33: When a tax is levied on the

Q34: How is the benefit from a tax

Q36: When a tax is imposed on a

Q37: Figure 8-2 Q38: What will a tax placed on coffee Q39: How is the benefit received by sellers Q40: Figure 8-1

![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents