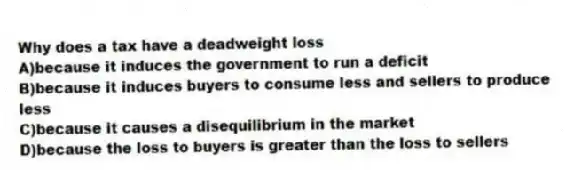

Why does a tax have a deadweight loss

A) because it induces the government to run a deficit

B) because it induces buyers to consume less and sellers to produce less

C) because it causes a disequilibrium in the market

D) because the loss to buyers is greater than the loss to sellers

Correct Answer:

Verified

Q52: What does the deadweight loss of taxation

Q53: Assume that the demand for fries is

Q54: How is the amount of deadweight loss

Q55: Figure 8-3 Q56: Figure 8-2 Q58: Suppose the government places a tax on Q59: Figure 8-3 Q60: What happens if the deadweight loss of Q61: Figure 8-4 Q62: Figure 8-4 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()

![]()

![]()