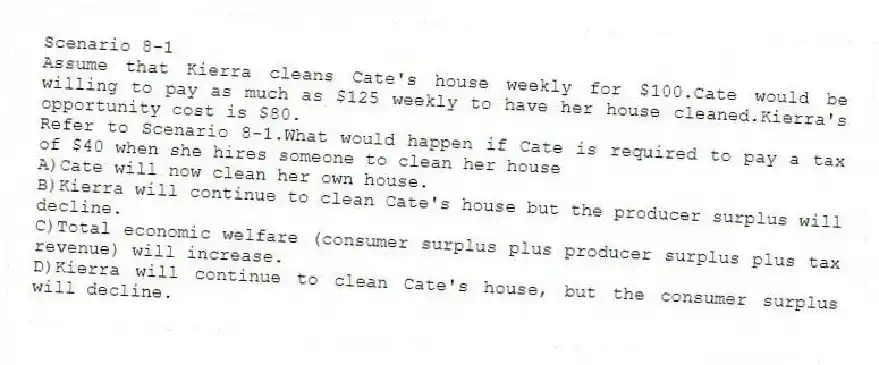

Scenario 8-1

Assume that Kierra cleans Cate's house weekly for $100.Cate would be willing to pay as much as $125 weekly to have her house cleaned.Kierra's opportunity cost is $80.

-Refer to Scenario 8-1.What would happen if Cate is required to pay a tax of $40 when she hires someone to clean her house

A) Cate will now clean her own house.

B) Kierra will continue to clean Cate's house but the producer surplus will decline.

C) Total economic welfare (consumer surplus plus producer surplus plus tax revenue) will increase.

D) Kierra will continue to clean Cate's house, but the consumer surplus will decline.

Correct Answer:

Verified

Q142: Assuming that the demand for diamonds is

Q143: Scenario 8-2

Lincoln offers to do Katelyn's housework

Q144: Scenario 8-1

Assume that Kierra cleans Cate's house

Q145: How are the size of the tax

Q146: If the supply of a good is

Q148: What happens as elasticities of supply and

Q149: Scenario 8-2

Lincoln offers to do Katelyn's housework

Q150: Assume that a tax is levied on

Q151: What is the relationship between the deadweight

Q152: Assume that the supply of gasoline is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents