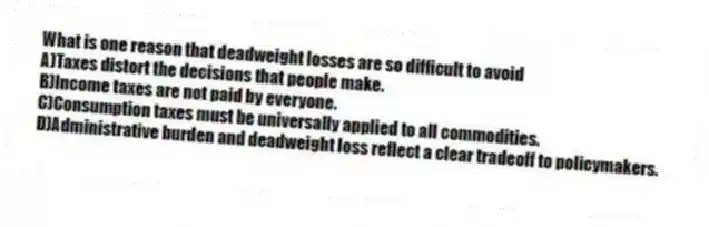

What is one reason that deadweight losses are so difficult to avoid

A) Taxes distort the decisions that people make.

B) Income taxes are not paid by everyone.

C) Consumption taxes must be universally applied to all commodities.

D) Administrative burden and deadweight loss reflect a clear tradeoff to policymakers.

Correct Answer:

Verified

Q42: Which factor makes up part of the

Q43: What does a deadweight loss from taxes

Q44: What did provincial government spending in 2013-2014

Q45: Among the major spending categories for provincial

Q46: For provincial governments,what percent of spending does

Q48: Who pays primarily for public schools,which educate

Q49: When the government taxes labour earnings,what can

Q50: What is the second largest component of

Q51: In which markets do deadweight losses occur

A)markets

Q52: Table 12-2

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents