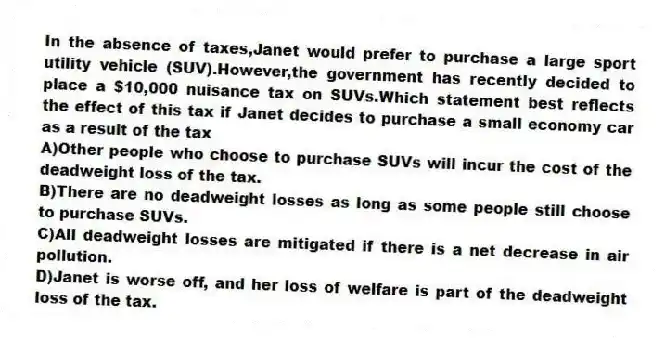

In the absence of taxes,Janet would prefer to purchase a large sport utility vehicle (SUV) .However,the government has recently decided to place a $10,000 nuisance tax on SUVs.Which statement best reflects the effect of this tax if Janet decides to purchase a small economy car as a result of the tax

A) Other people who choose to purchase SUVs will incur the cost of the deadweight loss of the tax.

B) There are no deadweight losses as long as some people still choose to purchase SUVs.

C) All deadweight losses are mitigated if there is a net decrease in air pollution.

D) Janet is worse off, and her loss of welfare is part of the deadweight loss of the tax.

Correct Answer:

Verified

Q73: What kind of taxes are deadweight losses

Q74: Table 12-3 Q75: What is part of the administrative burden Q76: Scenario 12-1 Q77: Scenario 12-1 Q79: What happens when interest income from savings Q80: Scenario 12-1 Q81: What happens if people do most of Q82: What would changing the basis of taxation Q83: Which statement best describes tax evasion

![]()

Suppose Jeremy and Kelsey receive great

Suppose Jeremy and Kelsey receive great

Suppose Jeremy and Kelsey receive great

A)It is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents