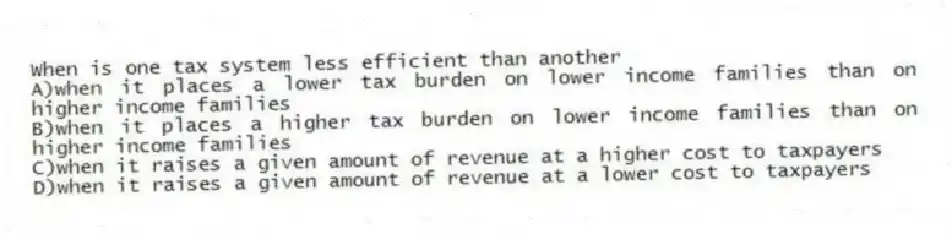

When is one tax system less efficient than another

A) when it places a lower tax burden on lower income families than on higher income families

B) when it places a higher tax burden on lower income families than on higher income families

C) when it raises a given amount of revenue at a higher cost to taxpayers

D) when it raises a given amount of revenue at a lower cost to taxpayers

Correct Answer:

Verified

Q56: Why has spending on health been the

Q57: What do social services primarily consist of

A)welfare

Q58: What is NOT a cost of taxes

Q59: Why do taxes create deadweight losses

A)They reduce

Q60: Table 12-2 Q62: Who generates the deadweight loss associated with Q63: Scenario 12-1 Q64: How is a tax system best defined Q65: Which of the following is an effect Q66: Table 12-3

![]()

Suppose Jeremy and Kelsey receive great

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents