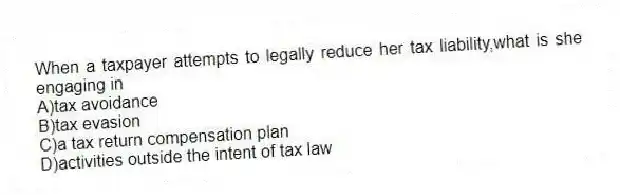

When a taxpayer attempts to legally reduce her tax liability,what is she engaging in

A) tax avoidance

B) tax evasion

C) a tax return compensation plan

D) activities outside the intent of tax law

Correct Answer:

Verified

Q85: What is a consumption tax

A)a tax on

Q86: What is an advantage of a consumption

Q87: What happens as tax laws become more

Q88: Table 12-4 Q89: If marginal tax rates increase,what results Q91: Which statement best describes the legality of Q92: Which of the following causes our current Q93: Which statement correctly characterizes high marginal tax Q94: Table 12-5 Q95: If your income is $40,000 and your![]()

A)Average tax![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents