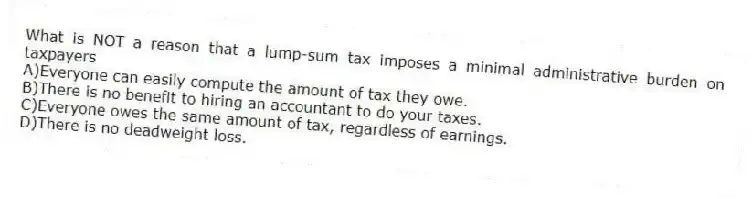

What is NOT a reason that a lump-sum tax imposes a minimal administrative burden on taxpayers

A) Everyone can easily compute the amount of tax they owe.

B) There is no benefit to hiring an accountant to do your taxes.

C) Everyone owes the same amount of tax, regardless of earnings.

D) There is no deadweight loss.

Correct Answer:

Verified

Q101: MaKenna earns income of $80,000 per year.Her

Q102: What is the most efficient tax possible

A)a

Q103: What is the most meaningful measure if

Q104: John faces a progressive tax structure that

Q105: MaKenna earns income of $80,000 per year.Her

Q107: What does the average tax rate measure

A)the

Q108: What are tax systems that impose record

Q110: If one is trying to gauge the

Q111: What is the difference between lump-sum taxes

Q386: Tim earns income of $60,000 per year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents