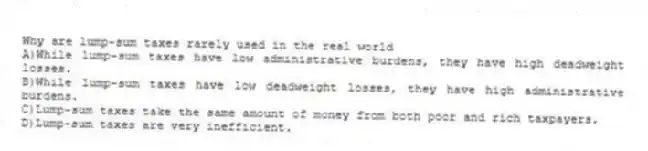

Why are lump-sum taxes rarely used in the real world

A) While lump-sum taxes have low administrative burdens, they have high deadweight losses.

B) While lump-sum taxes have low deadweight losses, they have high administrative burdens.

C) Lump-sum taxes take the same amount of money from both poor and rich taxpayers.

D) Lump-sum taxes are very inefficient.

Correct Answer:

Verified

Q124: "A $1000 tax paid by a poor

Q125: Table 12-7 Q126: If the government were to impose a Q127: The theory that the wealthy should contribute Q128: What is NOT an advantage of a Q130: What does horizontal equity state that taxpayers Q131: What is the benefits principle used to Q132: What is one advantage of a lump-sum Q133: If revenue from a gasoline tax is Q134: With a lump-sum tax,how is the average

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents