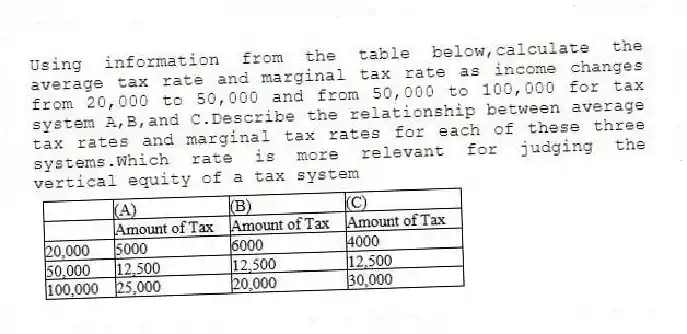

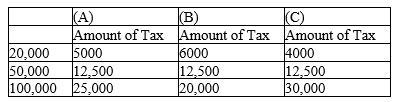

Using information from the table below,calculate the average tax rate and marginal tax rate as income changes from 20,000 to 50,000 and from 50,000 to 100,000 for tax system A,B,and C.Describe the relationship between average tax rates and marginal tax rates for each of these three systems.Which rate is more relevant for judging the vertical equity of a tax system

Correct Answer:

Verified

The marginal and average tax rates ea...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Tax evasion is legal, but tax avoidance

Q23: The equity of a tax system concerns

Q35: The administrative burden of any tax system

Q45: According to the benefits principle, it is

Q55: According to the ability-to-pay principle, it is

Q59: Antipoverty programs funded by taxes on the

Q65: Vertical equity is not consistent with a

Q187: In practice,Canadian income tax is filled with

Q192: Use Table A to complete Table B.

Table

Q193: Please complete the following table and show

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents