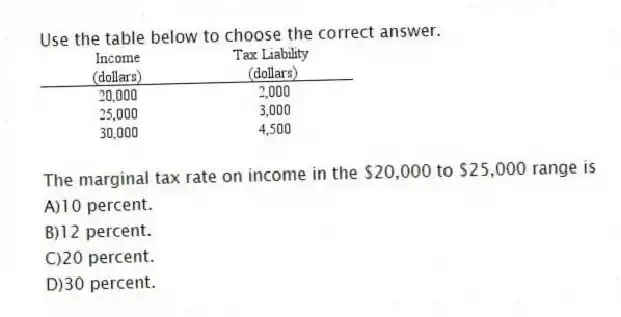

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Q145: Which of the following examples illustrates a

Q146: An income tax is progressive if the

A)

Q147: Which of the following examples illustrates a

Q150: A progressive tax

A) is one that taxes

Q153: A tax for which the average tax

Q154: Kathy works full time during the day

Q154: A progressive tax is defined as a

Q155: A tax for which the average tax

Q158: A proportional tax is defined as a

Q159: Many economists believe a general sales tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents