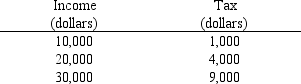

Use the table below to choose the correct answer.

For the income range illustrated, the tax shown here is

A) regressive.

B) proportional.

C) progressive.

D) regressive up to $20,000 but progressive beyond that.

Correct Answer:

Verified

Q103: A subsidy is defined as

A) a payment

Q113: In the supply and demand model, a

Q157: Which of the following examples illustrates a

Q160: According to the Laffer curve,

A) an increase

Q162: When the top marginal tax rates were

Q164: Use the table below to choose the

Q167: Use the table below to choose the

Q167: Approximately 50,000 luxury boats (priced $100,000 or

Q177: Data from the effects of the substantial

Q180: When the government increased its involvement in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents