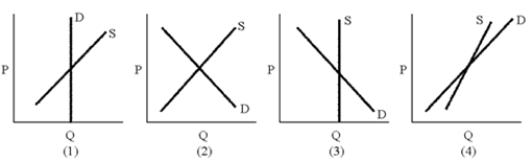

Figure 18-3

-In 1984, the South Carolina State Supreme Court ruled that a 20 percent admission tax on X-rated movies was unconstitutional.When the affected cinemas sought a refund of collected taxes, they were denied on the grounds that the tax, although collected by the theater, was indeed paid by the theatergoers.The Supreme Court apparently believed

A) the supply of X-rated movies was perfectly elastic.

B) the demand for X-rated movies was perfectly inelastic.

C) the legislation intended that the theatergoers pay the tax.

D) the burden fell on the theatergoers-there are no excess burdens on the theater.

Correct Answer:

Verified

Q189: Rhode Island has enacted a substantial increase

Q190: The incidence of cigarette taxes falls mainly

Q191: A tax that creates an excess burden

Q192: Many economists believe a comprehensive income tax

A)would

Q193: Which of the following is not true

Q195: Figure 18-3 Q196: Economists generally think that the _ tax Q197: If demand is more elastic, the portion Q198: Figure 18-3 Q199: Figure 18-2 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()