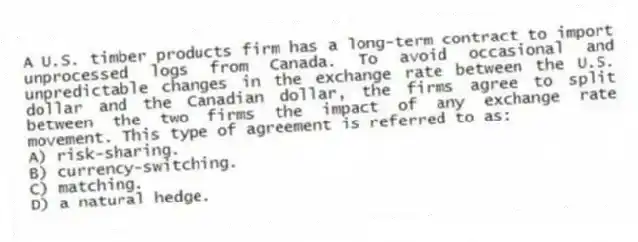

A U.S. timber products firm has a long-term contract to import unprocessed logs from Canada. To avoid occasional and unpredictable changes in the exchange rate between the U.S. dollar and the Canadian dollar, the firms agree to split between the two firms the impact of any exchange rate movement. This type of agreement is referred to as:

A) risk-sharing.

B) currency-switching.

C) matching.

D) a natural hedge.

Correct Answer:

Verified

Q32: The variability of a firm's operating cash

Q33: Which of the following is probably NOT

Q34: If a firm diversifies its financing sources,

Q35: Which of the following is NOT an

Q36: Moral hazard may occur when a firm

Q38: Purely domestic firms will be at a

Q39: An MNE has a contract for a

Q40: Which of the following is NOT an

Q41: Costs associated with the purchase of sizeable

Q42: Currency swaps are exclusively for periods of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents