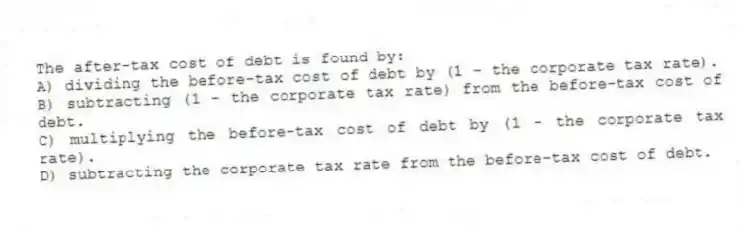

The after-tax cost of debt is found by:

A) dividing the before-tax cost of debt by (1 - the corporate tax rate) .

B) subtracting (1 - the corporate tax rate) from the before-tax cost of debt.

C) multiplying the before-tax cost of debt by (1 - the corporate tax rate) .

D) subtracting the corporate tax rate from the before-tax cost of debt.

Correct Answer:

Verified

Q5: Which of the following is NOT a

Q6: If a firm lies within a country

Q7: If a company fails to accurately predict

Q8: Which of the following is generally unnecessary

Q9: Other things equal, a firm that must

Q11: The capital asset pricing model (CAPM) is

Q12: Which of the following is NOT a

Q13: Relatively high costs of capital are more

Q14: Which of the following will NOT affect

Q15: A firm whose equity has a beta

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents