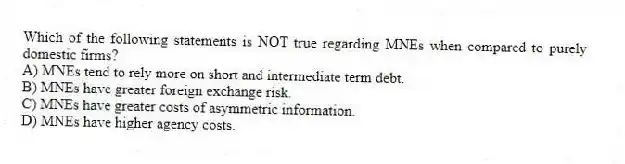

Which of the following statements is NOT true regarding MNEs when compared to purely domestic firms?

A) MNEs tend to rely more on short and intermediate term debt.

B) MNEs have greater foreign exchange risk.

C) MNEs have greater costs of asymmetric information.

D) MNEs have higher agency costs.

Correct Answer:

Verified

Q73: Despite the theoretical elegance of this hypothesis,

Q74: Empirical research has found that systematic risk

Q75: Empirical tests of market efficiency fail to

Q76: Portfolio theory assumes that investors are risk-averse.

Q77: Capital market segmentation is a financial market

Q78: The optimal capital budget:

A) occurs where the

Q80: Because of the international diversification of cash

Q81: What do theory and empirical evidence say

Q82: Empirical studies indicate that MNEs have a

Q83: Surprisingly, empirical studies find that MNEs have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents