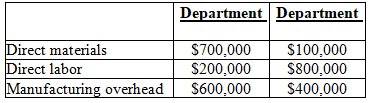

Apple Valley Corporation uses a job order cost system and has two production departments, A and B. Budgeted manufacturing costs for the year are:

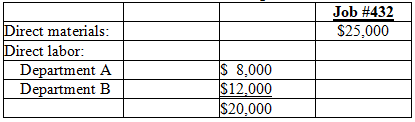

The actual material and labor costs charged to Job #432 are as follows:  Apple Valley applies manufacturing overhead costs to jobs on the basis of direct labor cost using departmental rates determined at the beginning of the year.

Apple Valley applies manufacturing overhead costs to jobs on the basis of direct labor cost using departmental rates determined at the beginning of the year.

-For Department B,the manufacturing overhead cost driver rate is:

A) 50% of direct labor costs.

B) 80% of direct labor costs.

C) 100% of direct labor costs.

D) 200% of direct labor costs.

Correct Answer:

Verified

Q43: Apple Valley Corporation uses a job order

Q45: In job order costing,the optimum number of

Q46: Each cost pool:

A)utilizes a separate cost driver

Q47: Tangipahoa Manufacturing uses departmental cost driver rates

Q49: Wood Manufacturing is a small textile manufacturer

Q50: Elfie Enterprises uses three cost pools to

Q52: Lois Manufacturing is a small clothing manufacturer

Q53: Apple Valley Corporation uses a job order

Q87: Answer the following questions using the information

Q131: Answer the following questions using the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents