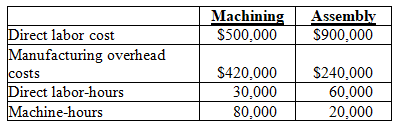

Sheppard Manufacturing uses departmental cost driver rates to allocate manufacturing overhead costs to products. Manufacturing overhead costs are allocated on the basis of machine hours in the Machining Department and on the basis of direct labor hours in the Assembly Department. At the beginning of 2011, the following estimates were provided for the coming year:  The accounting records of the company show the following data for Job #316:

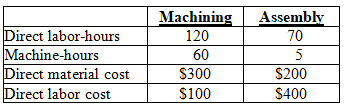

The accounting records of the company show the following data for Job #316:

-For the Machining Department,what is the annual manufacturing overhead cost driver rate?

A) $4.00 per machine hour

B) $4.20 per machine hour

C) $4.67 per machine hour

D) $5.25 per machine hour

Correct Answer:

Verified

Q55: Apple Valley Corporation uses a job order

Q56: Wisconsin Electronics has received an order for

Q57: Different products consume different proportions of manufacturing

Q58: More cost pools:

A)always result in better estimates

Q60: Wisconsin Electronics has received an order for

Q61: Explain how an activity cost driver rate

Q62: In job order costing,explain how comparing actuals

Q63: Why is an accurate product cost important?

Q64: In a job order costing system,explain why

Q134: Answer the following questions using the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents