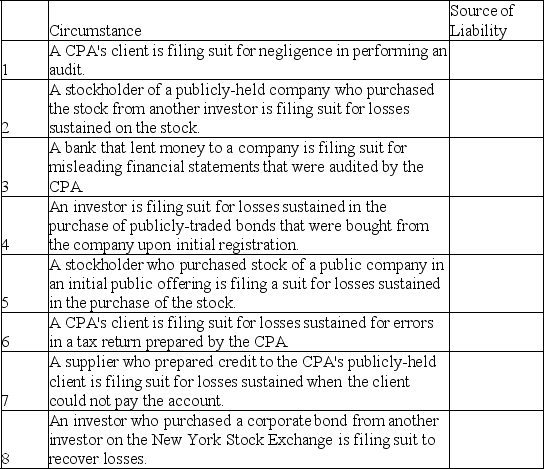

A plaintiff may elect to bring a lawsuit against auditors under applicable statutes-including the Securities Act of 1933 and the Securities Exchange Act of 1934-and under common law.For each circumstance,indicate the most likely source of CPA liability by placing the appropriate letter in the third column.

A.The Securities Act of 1933

B.The Securities Exchange Act of 1934

C.Common Law

Correct Answer:

Verified

Q51: Under common law,when performing an audit,a CPA:

A)Must

Q52: In addition to proving a loss,which

Q53: Under common law,which of the following statements

Q54: If a CPA recklessly departs from the

Q55: A CPA's duty of due care to

Q56: In a common law action against an

Q58: Auditors may be held liable to both

Q59: Hark,CPA,negligently failed to follow generally accepted auditing

Q60: Under which act (or acts)must a

Q61: A CPA firm has audited the financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents