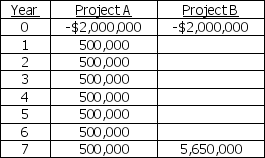

Company K is considering two mutually exclusive projects.The cash flows of the projects are as follows:

a.Compute the NPV and IRR for the above two projects,assuming a 13% required rate of return.

b.Discuss the ranking conflict.

c.What decision should be made regarding these two projects?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: Capital rationing generally leads to higher stock

Q138: A project's equivalent annual annuity (EAA)is the

Q139: If a project's IRR is equal to

Q140: You are in charge of one division

Q141: Which of the following statements about the

Q143: Lithium,Inc.is considering two mutually exclusive projects,A and

Q144: Interstate Appliance Inc.is considering the following 3

Q145: Your firm is considering an investment that

Q146: The Net Present Value (or NPV)criteria for

Q147: Lithium,Inc.is considering two mutually exclusive projects,A and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents