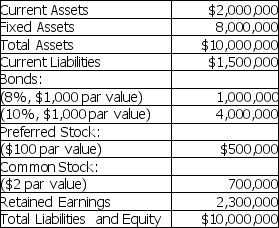

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows:

MAX Corporation

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Correct Answer:

Verified

Q146: Balon Plastics,Inc.is financed entirely with 3 million

Q147: Basic tools of capital-structure management include

A) EBIT-EPS

Q148: The Modigliani and Miller hypothesis does NOT

Q149: The EBIT-EPS indifference point is the level

Q150: Sunshine Candy Company's capital structure for the

Q151: Above the EBIT-EPS indifference point,a more heavily

Q152: Premium Lodging,Inc.,is financed entirely with 3 million

Q153: Because there are no fixed financing costs,a

Q154: The primary weakness of EBIT-EPS analysis is

Q156: The EBIT-EPS indifference point

A) identifies the EBIT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents