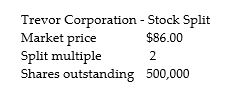

Kelly owns 10,000 shares in McCormick Spices,which currently has 500,000 shares outstanding.The stock sells for $86 on the open market.McCormick's management has decided on a two-for-one split.

a.Will Kelly's financial position change after the split,assuming that the stock's price will fall proportionately?

b.Assuming only a 35% decrease in the stock price,what will be Kelly's value after the split?

Correct Answer:

Verified

Q150: From the shareholders' perspective,a stock repurchase has

Q151: Farrah owns 5,000 shares of stock in

Q152: Dryden,Corp.has 500,000 shares of common stock outstanding,a

Q153: All of the following are rationales given

Q154: What is the economic difference between a

Q156: Assume that Plavor Brands,Inc.has 10,000,000 common shares

Q157: Outpost has 2 million shares of common

Q158: A stock repurchase plan can be viewed

Q159: Ted Tech Inc.is offering a 10% stock

Q160: A stock repurchase plan that involves issuing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents