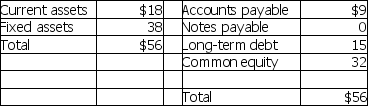

The balance sheet of the Emery Company is presented below:

Emery Company Balance Sheet

March 31,2010

(Millions of Dollars)

For the year ending March 31,2010,Jackson had sales of $58 million.The common stockholders receive all net earnings of the firm in the form of cash dividends,leaving no funds from earnings available to the firm for expansion (assume that depreciation expense is just equal to the cost of replacing worn-out assets).

Construct a pro forma balance sheet for March 31,2011 for an expected level of sales of $75.4 million.Assume current assets and accounts payable vary as a percent of sales,and fixed assets remain at the present level.Use notes payable as discretionary financing.

Correct Answer:

Verified

Pro ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Cash budgets do not provide reasonable predictions

Q82: The balance sheet for the Long Drive

Q83: The percent of sales method provides a

Q84: If a firm currently has excess capacity,then

Q85: What is the percent of sales method

Q87: The term "lumpy asset" means

A) the same

Q88: Amalgamated Enterprises is planning to purchase some

Q89: MDX Sales Corp.is expecting a 10% increase

Q90: Southeast Wood Products,Inc.reports sales of $20,000,000 and

Q91: The ZYX Corporation is planning to request

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents