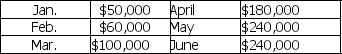

Rawhide Outfitters had projected its sales for the first six months of 2012 to be as follows:

Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2012 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2012.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2012?

A) $110,000

B) $15,000

C) $70,000

D) $85,000

Correct Answer:

Verified

Q108: The cash budget consists of all the

Q126: Fielding Wilderness Outfitters had projected its sales

Q128: All of the following are found in

Q129: The primary purpose of a cash budget

Q130: Which of the following would NOT be

Q132: LPD Logistics,Inc.'s projected sales for the first

Q133: Plato Industries' projected sales for the first

Q134: LPD Logistics,Inc.'s projected sales for the first

Q135: Rawhide Outfitters had projected its sales for

Q136: A company collects 25% of its sales

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents