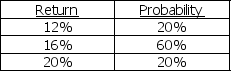

You are given the following probability distribution for XYZ common stock's returns during the next year,which are assumed to be normally distributed.Show all work below,and complete the following:

a.Calculate the standard deviation of the returns,and round to the nearest one-half percent.

b.Draw a graphical representation of XYZ's normal distribution below (ye old bell-shaped curve).LABEL THE AXES OF THE GRAPH OR THE FOLLOWING RESULTS WILL BE MEANINGLESS.Using your result in part A for the standard deviation (rounded to the nearest one-half percent)explain and indicate on the graph,the probability that XYZ will return more than 13.5%,assuming a normal distribution.

Correct Answer:

Verified

a.Exp.Return = (.12 × .2)+ (.16 ×...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: You are going to invest all of

Q25: Assume that you have $330,000 invested in

Q26: Assume that you expect to hold a

Q27: How is risk defined?

Q28: Investment A and Investment B both have

Q30: You must add one of two investments

Q31: Small company stocks have historically had higher

Q32: Bay Land,Inc.has the following distribution of returns:

Q33: Which of the following investments is clearly

Q34: You are considering investing in a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents