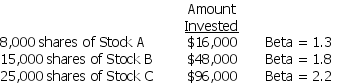

An investor currently holds the following portfolio:

The investor is worried that the beta of his portfolio is too high,so he wants to sell some stock C and add stock D,which has a beta of 1.0,to his portfolio.If the investor wants his portfolio to have a beta of 1.72,how much stock C must he replace with stock D?

A) $18,000

B) $24,000

C) $31,000

D) $36,000

Correct Answer:

Verified

Q63: Beta is a statistical measure of

A) unsystematic

Q64: You are considering buying some stock in

Q65: The slope of the characteristic line of

Q66: Beta represents the average movement of a

Q67: A well-diversified portfolio includes investments in 50

Q69: Because risk is measured by variability of

Q70: Which of the following statements is MOST

Q71: A stock's beta is a measure of

Q72: Portfolio performance is determined mainly by stock

Q73: The market rewards the patient investor,for between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents