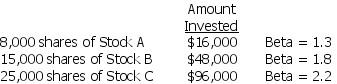

An investor currently holds the following portfolio:

If the risk-free rate of return is 2% and the market risk premium is 7%,then the required return on the portfolio is

A) 14.91%.

B) 15.93%.

C) 21.91%.

D) 23.93%.

Correct Answer:

Verified

Q106: As the required rate of return of

Q107: Define systematic and unsystematic risk.What method is

Q108: A typical measure for the risk-free rate

Q109: Stock A has a beta of 1.2

Q110: In general,the required rate of return is

Q112: According to the CAPM,for each unit of

Q113: Discuss whether the standard deviation of a

Q114: Stocks that plot above the security market

Q115: The S&P 500 index must be used

Q116: The required rate of return for an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents