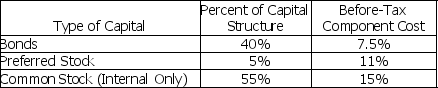

Given the following information on S & G Inc.'s capital structure,compute the company's weighted average cost of capital.

The company's marginal tax rate is 40%.

A) 13.3%

B) 7.1%

C) 10.6%

D) 10%

Correct Answer:

Verified

Q114: Last year Gator Getters,Inc.had $50 million in

Q115: The average cost associated with each additional

Q116: A corporate bond has a face value

Q117: If the before-tax cost of debt is

Q118: Calculating the cost of capital for divisions

Q120: WineCellars Inc.currently has a weighted average cost

Q121: QRM,Inc.'s marginal tax rate is 35%.It can

Q122: What are the implications for a firm's

Q123: Why should firms that own and operate

Q124: Texas Transport has five possible investment projects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents