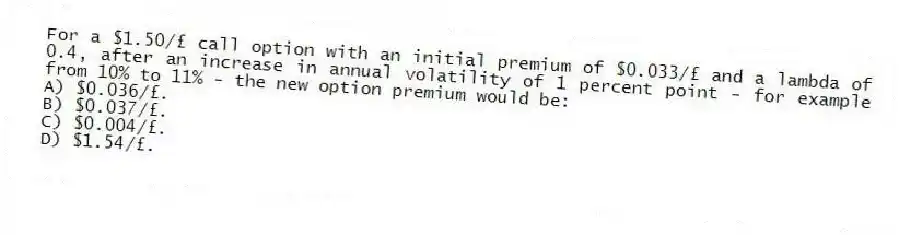

For a $1.50/£ call option with an initial premium of $0.033/£ and a lambda of 0.4, after an increase in annual volatility of 1 percent point - for example from 10% to 11% - the new option premium would be:

A) $0.036/£.

B) $0.037/£.

C) $0.004/£.

D) $1.54/£.

Correct Answer:

Verified

Q50: The time value is asymmetric in value

Q51: If the spot rate changes from $1.70/£

Q52: As an option moves further in-the-money, delta

Q53: Define and explain the logic for the

Q54: Most option profits and losses are realized

Q56: Traders who believe volatilities will fall significantly

Q57: Foreign currency options are available both over-the-counter

Q58: Volatility is viewed the following ways EXCEPT:

A)

Q59: The price of an option is always

Q60: Option premiums deteriorate at a/an _ as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents