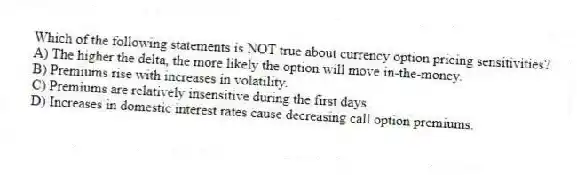

Which of the following statements is NOT true about currency option pricing sensitivities?

A) The higher the delta, the more likely the option will move in-the-money.

B) Premiums rise with increases in volatility.

C) Premiums are relatively insensitive during the first days.

D) Increases in domestic interest rates cause decreasing call option premiums.

Correct Answer:

Verified

Q72: Option volatility is defined as the square

Q73: The majority of the option premium is

Q74: As long as the option has time

Q75: The Delta of an option is defined

Q76: Standard foreign currency options are priced around

Q78: If the rho of the specific option

Q79: The higher the delta the greater the

Q80: The value of any option that is

Q81: If the exchange rate's volatility is rising,

Q82: Traders by using the historical volatility assume

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents