Instruction 8.1: For the Following Problem(s), Consider These Debt Strategies Being Considered

Instruction 8.1:

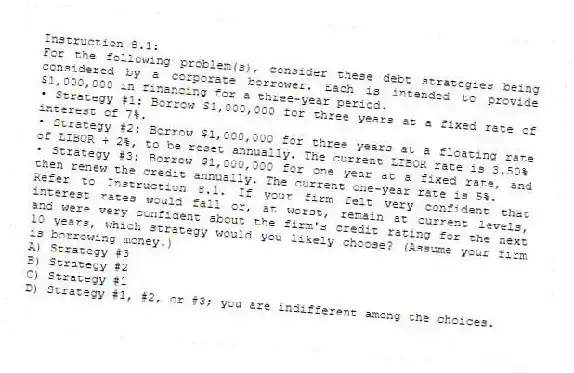

For the following problem(s) , consider these debt strategies being considered by a corporate borrower. Each is intended to provide $1,000,000 in financing for a three-year period.

• Strategy #1: Borrow $1,000,000 for three years at a fixed rate of interest of 7%.

• Strategy #2: Borrow $1,000,000 for three years at a floating rate of LIBOR + 2%, to be reset annually. The current LIBOR rate is 3.50%

• Strategy #3: Borrow $1,000,000 for one year at a fixed rate, and then renew the credit annually. The current one-year rate is 5%.

-Refer to Instruction 8.1. If your firm felt very confident that interest rates would fall or, at worst, remain at current levels, and were very confident about the firm's credit rating for the next 10 years, which strategy would you likely choose? (Assume your firm is borrowing money.)

A) Strategy #3

B) Strategy #2

C) Strategy #1

D) Strategy #1, #2, or #3; you are indifferent among the choices.

Correct Answer:

Verified

Q3: Instruction 8.1:

For the following problem(s), consider these

Q4: The London Interbank Offered Rate (LIBOR) is

Q5: The basis point spreads between credit ratings

Q6: Instruction 8.1:

For the following problem(s), consider these

Q7: For a corporate borrower, it is especially

Q9: Individual borrowers - whether they be governments

Q10: Instruction 8.1:

For the following problem(s), consider these

Q11: Instruction 8.1:

For the following problem(s), consider these

Q12: Some of the world's largest and most

Q13: Instruction 8.1:

For the following problem(s), consider these

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents