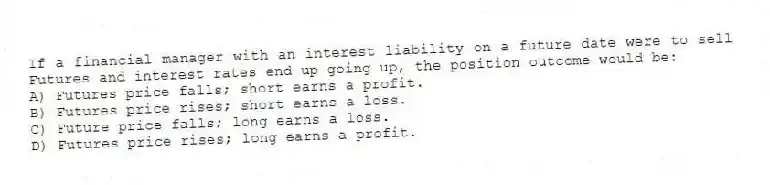

If a financial manager with an interest liability on a future date were to sell Futures and interest rates end up going up, the position outcome would be:

A) Futures price falls; short earns a profit.

B) Futures price rises; short earns a loss.

C) Future price falls; long earns a loss.

D) Futures price rises; long earns a profit.

Correct Answer:

Verified

Q21: A firm with variable-rate debt that expects

Q22: A/an _ is a contract to lock

Q23: An agreement to exchange interest payments based

Q24: Your firm is faced with paying a

Q25: If a financial manager earning interest on

Q27: Which of the following would be considered

Q28: The potential exposure that any individual firm

Q29: A basis point is one-tenth of one

Q30: An agreement to swap the currencies of

Q31: The interest rate swap strategy of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents