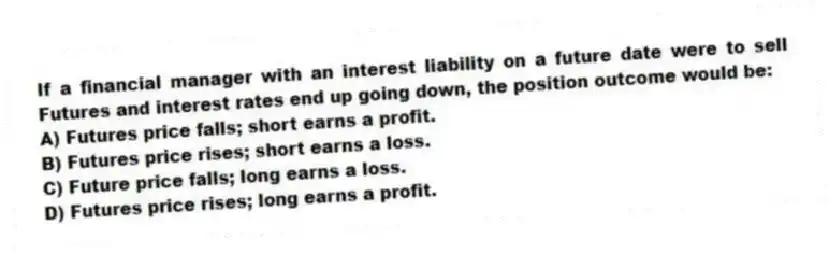

If a financial manager with an interest liability on a future date were to sell Futures and interest rates end up going down, the position outcome would be:

A) Futures price falls; short earns a profit.

B) Futures price rises; short earns a loss.

C) Future price falls; long earns a loss.

D) Futures price rises; long earns a profit.

Correct Answer:

Verified

Q32: Unlike the situation with exchange rate risk,

Q33: An agreement to swap a fixed interest

Q34: Which of the following is an unlikely

Q35: The financial manager of a firm has

Q36: A firm with fixed-rate debt that expects

Q38: Interest rate futures are relatively unpopular among

Q39: An interbank-traded contract to buy or sell

Q40: If a financial manager earning interest on

Q41: A swap agreement may involve currencies or

Q42: Counterparty risk is greater for exchange-traded derivatives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents