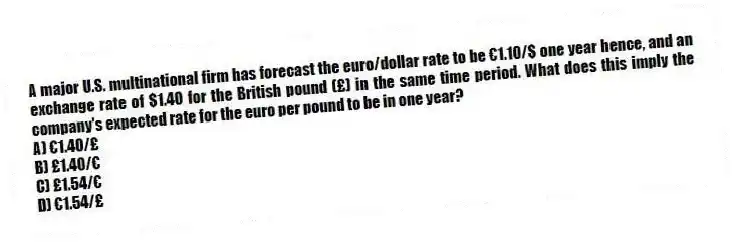

A major U.S. multinational firm has forecast the euro/dollar rate to be €1.10/$ one year hence, and an exchange rate of $1.40 for the British pound (£) in the same time period. What does this imply the company's expected rate for the euro per pound to be in one year?

A) €1.40/£

B) £1.40/€

C) £1.54/€

D) €1.54/£

Correct Answer:

Verified

Q37: Which of the following is NOT a

Q38: If the goal were to increase the

Q39: The Asian Currency crisis appeared to begin

Q40: Which of the following is NOT a

Q41: The smaller and less liquid markets and

Q43: In 1991, Argentina adopted a currency board

Q44: As economic conditions continued to deteriorate in

Q45: The single most important element of technical

Q46: _, traditionally referred to as chartists, focus

Q47: The _ is the Argentine currency unit.

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents