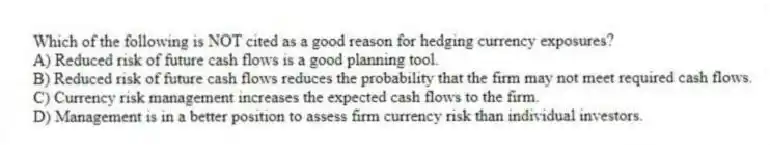

Which of the following is NOT cited as a good reason for hedging currency exposures?

A) Reduced risk of future cash flows is a good planning tool.

B) Reduced risk of future cash flows reduces the probability that the firm may not meet required cash flows.

C) Currency risk management increases the expected cash flows to the firm.

D) Management is in a better position to assess firm currency risk than individual investors.

Correct Answer:

Verified

Q8: Many MNE s manage foreign exchange exposure

Q9: There is considerable question among investors and

Q10: _ exposure measures the change in the

Q11: Managers CAN outguess the market. If and

Q12: Assuming no transaction costs (i.e., hedging is

Q14: _ exposure is the potential for accounting-derived

Q15: Shareholders are LESS capable of diversifying currency

Q16: Management often conducts hedging activities that benefit

Q17: Transaction exposure and operating exposure exist because

Q18: Losses from _ exposure generally reduce taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents