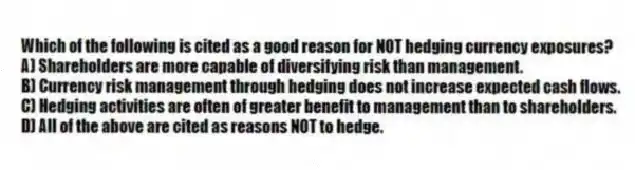

Which of the following is cited as a good reason for NOT hedging currency exposures?

A) Shareholders are more capable of diversifying risk than management.

B) Currency risk management through hedging does not increase expected cash flows.

C) Hedging activities are often of greater benefit to management than to shareholders.

D) All of the above are cited as reasons NOT to hedge.

Correct Answer:

Verified

Q2: Hedging, or reducing risk, is the same

Q3: Each of the following is another name

Q4: MNE cash flows may be sensitive to

Q5: A _ hedge refers to an offsetting

Q6: As a generalized rule, only realized foreign

Q8: Many MNE s manage foreign exchange exposure

Q9: There is considerable question among investors and

Q10: _ exposure measures the change in the

Q11: Managers CAN outguess the market. If and

Q12: Assuming no transaction costs (i.e., hedging is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents