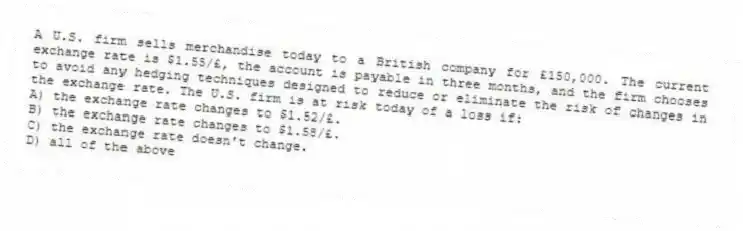

A U.S. firm sells merchandise today to a British company for £150,000. The current exchange rate is $1.55/£, the account is payable in three months, and the firm chooses to avoid any hedging techniques designed to reduce or eliminate the risk of changes in the exchange rate. The U.S. firm is at risk today of a loss if:

A) the exchange rate changes to $1.52/£.

B) the exchange rate changes to $1.58/£.

C) the exchange rate doesn't change.

D) all of the above

Correct Answer:

Verified

Q18: Losses from _ exposure generally reduce taxable

Q19: The key arguments in opposition to currency

Q20: Losses from _ exposure generally reduce taxable

Q21: Instruction 10.1:

Use the information for the following

Q22: When attempting to manage an account payable

Q24: A U.S. firm sells merchandise today to

Q25: Remaining unhedged is NOT an option when

Q26: _ is NOT a commonly used contractual

Q27: Does foreign currency exchange hedging both reduce

Q28: Instruction 10.1:

Use the information for the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents