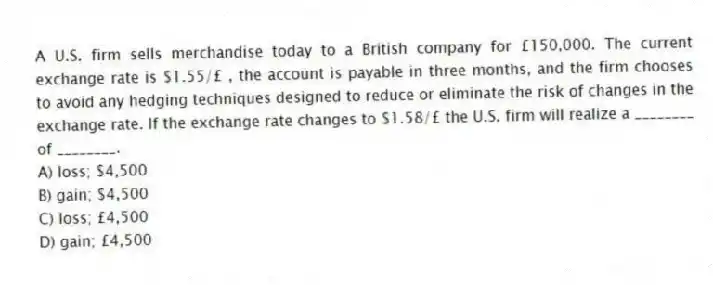

A U.S. firm sells merchandise today to a British company for £150,000. The current exchange rate is $1.55/£ , the account is payable in three months, and the firm chooses to avoid any hedging techniques designed to reduce or eliminate the risk of changes in the exchange rate. If the exchange rate changes to $1.58/£ the U.S. firm will realize a ________ of ________.

A) loss; $4,500

B) gain; $4,500

C) loss; £4,500

D) gain; £4,500

Correct Answer:

Verified

Q35: Instruction 10.1:

Use the information for the following

Q36: Instruction 10.1:

Use the information for the following

Q37: Hedging can be advantageous to shareholders because

Q38: Transaction exposure could arise when borrowing or

Q39: Instruction 10.1:

Use the information for the following

Q41: With a perfect hedge, there is no

Q42: The objective of currency hedging is to

Q43: In efficient markets, interest rate parity should

Q44: Currency risk management techniques include forward hedges,

Q45: According to a survey by Bank of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents