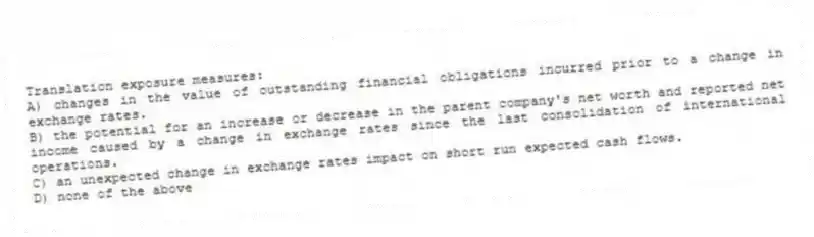

Translation exposure measures:

A) changes in the value of outstanding financial obligations incurred prior to a change in exchange rates.

B) the potential for an increase or decrease in the parent company's net worth and reported net income caused by a change in exchange rates since the last consolidation of international operations.

C) an unexpected change in exchange rates impact on short run expected cash flows.

D) none of the above

Correct Answer:

Verified

Q1: A foreign subsidiary's _ currency is the

Q3: Translation exposure may also be called _

Q4: Gains or losses caused by translation adjustments

Q5: According to your authors, the main purpose

Q6: A foreign subsidiary's functional currency is the

Q7: Under the U.S. method of translation procedures,

Q8: A/An _ subsidiary is one in which

Q9: It is possible to use different exchange

Q10: The two basic methods for the translation

Q11: The _ determines accounting policy for U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents