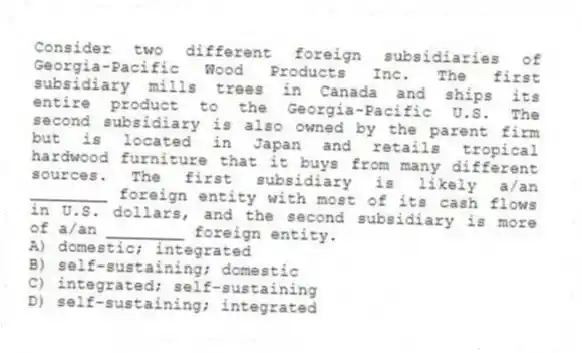

Consider two different foreign subsidiaries of Georgia-Pacific Wood Products Inc. The first subsidiary mills trees in Canada and ships its entire product to the Georgia-Pacific U.S. The second subsidiary is also owned by the parent firm but is located in Japan and retails tropical hardwood furniture that it buys from many different sources. The first subsidiary is likely a/an ________ foreign entity with most of its cash flows in U.S. dollars, and the second subsidiary is more of a/an ________ foreign entity.

A) domestic; integrated

B) self-sustaining; domestic

C) integrated; self-sustaining

D) self-sustaining; integrated

Correct Answer:

Verified

Q11: The _ determines accounting policy for U.S.

Q12: If the same exchange rate were used

Q13: Generally speaking, translation methods by country define

Q14: It is highly unusual for a multinational

Q15: The basic advantage of the _ method

Q17: _ exposure is the potential for an

Q18: Historical exchange rates may be used for

Q19: Most countries specify the translation method to

Q20: If an imbalance results from the accounting

Q21: _ occur as a result of changes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents