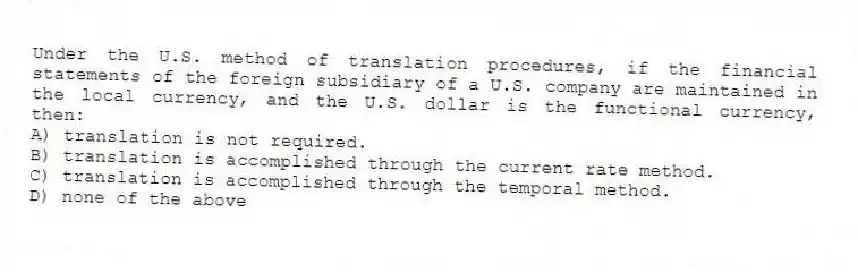

Under the U.S. method of translation procedures, if the financial statements of the foreign subsidiary of a U.S. company are maintained in the local currency, and the U.S. dollar is the functional currency, then:

A) translation is not required.

B) translation is accomplished through the current rate method.

C) translation is accomplished through the temporal method.

D) none of the above

Correct Answer:

Verified

Q20: If an imbalance results from the accounting

Q21: _ occur as a result of changes

Q22: Translation gains or losses can be quite

Q23: Under U.S. accounting and translation practices, use

Q24: If the European subsidiary of a U.S.

Q26: If the British subsidiary of a European

Q27: Under U.S. accounting and translation practices, use

Q28: The current rate method and the temporal

Q29: Exchange rate imbalances that are passed through

Q30: The two methods for the translation of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents