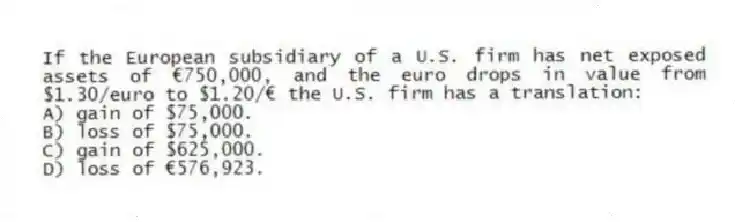

If the European subsidiary of a U.S. firm has net exposed assets of €750,000, and the euro drops in value from $1.30/euro to $1.20/€ the U.S. firm has a translation:

A) gain of $75,000.

B) loss of $75,000.

C) gain of $625,000.

D) loss of €576,923.

Correct Answer:

Verified

Q35: If the British subsidiary of a European

Q36: The biggest advantage of the current rate

Q37: Which of the following primary principles of

Q38: The temporal rate method is the most

Q39: Under the temporal rate method, specific assets

Q41: If a firm's subsidiary is using the

Q42: A balance sheet hedge requires that the

Q43: If management expects a foreign currency to

Q44: A Canadian subsidiary of a U.S. parent

Q45: If the parent firm and all subsidiaries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents