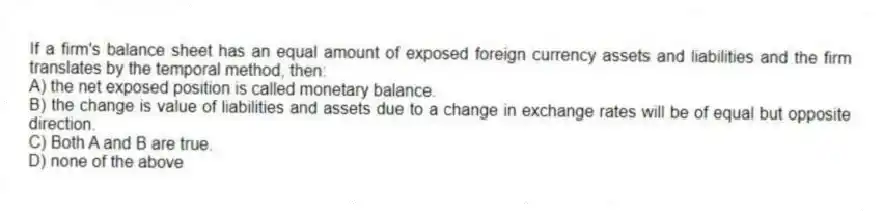

If a firm's balance sheet has an equal amount of exposed foreign currency assets and liabilities and the firm translates by the temporal method, then:

A) the net exposed position is called monetary balance.

B) the change is value of liabilities and assets due to a change in exchange rates will be of equal but opposite direction.

C) Both A and B are true.

D) none of the above

Correct Answer:

Verified

Q44: A Canadian subsidiary of a U.S. parent

Q45: If the parent firm and all subsidiaries

Q46: One possible reason for a balance sheet

Q47: The main technique to minimize translation exposure

Q48: Describe a balance sheet hedge and give

Q49: The value contribution of a subsidiary of

Q50: It is possible that efforts to decrease

Q51: _ gains and losses are "realized" whereas

Q53: One possible reason for a balance sheet

Q54: If management anticipates an appreciation of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents