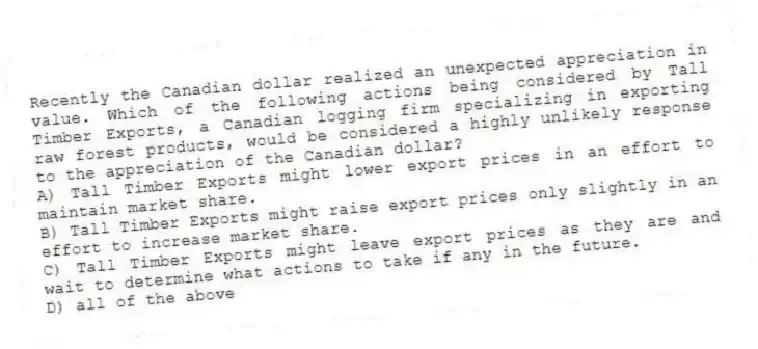

Recently the Canadian dollar realized an unexpected appreciation in value. Which of the following actions being considered by Tall Timber Exports, a Canadian logging firm specializing in exporting raw forest products, would be considered a highly unlikely response to the appreciation of the Canadian dollar?

A) Tall Timber Exports might lower export prices in an effort to maintain market share.

B) Tall Timber Exports might raise export prices only slightly in an effort to increase market share.

C) Tall Timber Exports might leave export prices as they are and wait to determine what actions to take if any in the future.

D) all of the above

Correct Answer:

Verified

Q1: Another name for operating exposure is _

Q2: Expected changes in foreign exchange rates should

Q4: The goal of operating exposure analysis is

Q5: The higher the price elasticity of demand,

Q6: Operating cash flows may occur in different

Q7: The strategy management undertakes in response to

Q8: Which of the following is NOT an

Q9: When considering the phases of adjustment and

Q10: Even though contracts are often fixed in

Q11: Which of the following is NOT an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents