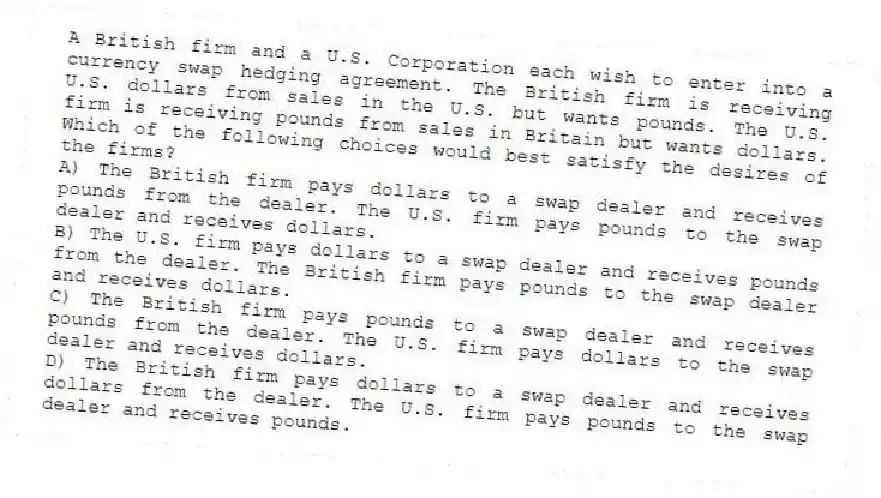

A British firm and a U.S. Corporation each wish to enter into a currency swap hedging agreement. The British firm is receiving U.S. dollars from sales in the U.S. but wants pounds. The U.S. firm is receiving pounds from sales in Britain but wants dollars. Which of the following choices would best satisfy the desires of the firms?

A) The British firm pays dollars to a swap dealer and receives pounds from the dealer. The U.S. firm pays pounds to the swap dealer and receives dollars.

B) The U.S. firm pays dollars to a swap dealer and receives pounds from the dealer. The British firm pays pounds to the swap dealer and receives dollars.

C) The British firm pays pounds to a swap dealer and receives pounds from the dealer. The U.S. firm pays dollars to the swap dealer and receives dollars.

D) The British firm pays dollars to a swap dealer and receives dollars from the dealer. The U.S. firm pays pounds to the swap dealer and receives pounds.

Correct Answer:

Verified

Q42: Currency swaps are exclusively for periods of

Q43: Swap agreements are treated as line items

Q44: Most swap dealers arrange swaps so that

Q45: NorthRim Inc. (NRI), imports extreme condition outdoor

Q46: A _ is the term used to

Q48: Swap agreements are treated as off-balance sheet

Q49: Most swap dealers arrange swaps so that

Q50: A _ occurs when two business firms

Q51: A British firm has a subsidiary in

Q52: The empirical evidence strongly supports the proposition

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents